| Volltext anzeigen | |

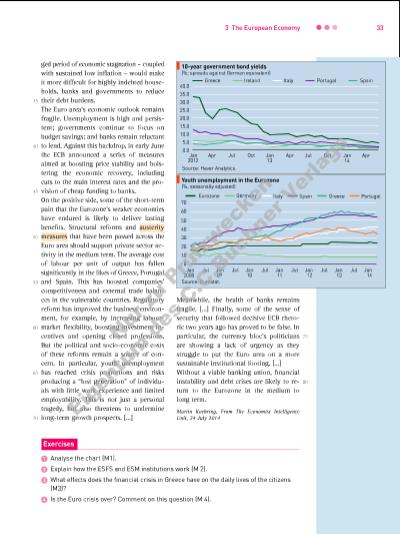

333 The European Economy ged period of economic stagnation – coupled with sustained low inflation – would make it more difficult for highly indebted households, banks and governments to reduce their debt burdens. The Euro area’s economic outlook remains fragile. Unemployment is high and persistent; governments continue to focus on budget savings; and banks remain reluctant to lend. Against this backdrop, in early June the ECB announced a series of measures aimed at boosting price stability and bolstering the economic recovery, including cuts to the main interest rates and the provision of cheap funding to banks. On the positive side, some of the short-term pain that the Eurozone’s weaker economies have endured is likely to deliver lasting benefits. Structural reforms and austerity measures that have been passed across the Euro area should support private sector activity in the medium term. The average cost of labour per unit of output has fallen significantly in the likes of Greece, Portugal and Spain. This has boosted companies’ competitiveness and external trade balances in the vulnerable countries. Regulatory reform has improved the business environment, for example, by increasing labourmarket flexibility, boosting investment incentives and opening closed professions. But the political and socio-economic costs of these reforms remain a source of concern. In particular, youth unemployment has reached crisis proportions and risks producing a “lost generation” of individuals with little work experience and limited employability. This is not just a personal tragedy, but also threatens to undermine long-term growth prospects. […] Meanwhile, the health of banks remains fragile. […] Finally, some of the sense of security that followed decisive ECB rhetoric two years ago has proved to be false. In particular, the currency bloc’s politicians are showing a lack of urgency as they struggle to put the Euro area on a more sustainable institutional footing. […] Without a viable banking union, financial instability and debt crises are likely to return to the Eurozone in the medium to long term. Martin Koehring, From The Economist Intelligence Unit, 24 July 2014 Analyse the chart (M1). 2 Explain how the ESFS and ESM institutions work (M 2). 3 What effects does the financial crisis in Greece have on the daily lives of the citizens (M3)? 4 Is the Euro crisis over? Comment on this question (M 4). Exercises 10-year government bond yields (%; spreads against German equivalent) Source: Haver Analytics. 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Jan 2012 13 14 Apr Jul Oct Jan Apr Jul Oct Jan Apr Greece Ireland Italy Portugal Spain Youth unemployment in the Eurozone (%; seasonally adjusted) Source: Eurostat. 0 10 20 30 40 50 60 70 Jan Jan Jan Jan Jan Jan Jan 2008 09 10 11 12 13 14 Jul Jul Jul Jul Jul Jul Eurozone Germany Italy Spain Greece Portugal 35 40 45 50 55 60 65 70 75 80 71051_1_1_2015_Inhalt_4.indd 33 21.01.15 10:40 Nu r z u Pr üf zw ec ke n Ei g n um d e C .C .B uc hn er V er la gs | |

« |  » |

|

» Zur Flash-Version des Livebooks | |